Cheap Auto Insurance in Rhode Island for 2025 (Big Savings With These 10 Companies!)

State Farm offers the cheapest rates for cheap auto insurance in Rhode Island at $32 per month, followed by Travelers at $44 and Progressive at $49. Meeting state insurance requirements while keeping costs low is crucial. Compare top providers to find the best coverage for your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Rhode Island

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsRhode Island Auto Insurance Statistics Summary

| Statistic | Value |

|---|---|

| Total Road Miles | 6,027 miles |

| Vehicle Miles Driven Annually | 7,677 million miles |

| Registered Vehicles | 832,892 |

| Vehicle Theft Incidents | 1,833 |

| Driving Fatalities (2017) | Speeding: 41, DUI: 34 |

| Most Popular Vehicle | Toyota RAV4 |

| State Rank in Auto Insurance Costs (2023) | 3rd highest in the U.S. |

Your driving record, vehicle type, and location impact rates. Compare cheap auto insurance rates to find the best deal on low-cost coverage.

Beyond rates, we’ll discuss Rhode Island’s minimum coverage requirements, tips for reducing premiums, and must-know state driving laws.

Our Top 10 Company Picks: Cheap Auto Insurance in Rhode Island

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | B | Low Rates | State Farm | |

| #2 | $44 | A++ | Customer Service | Travelers | |

| #3 | $49 | A+ | Custom Coverage | Progressive | |

| #4 | $53 | A++ | Policy Variety | Geico | |

| #5 | $64 | A | Claims Handling | American Family | |

| #6 | $78 | A | Comprehensive Plans | Farmers | |

| #7 | $80 | A+ | Family Savings | Allstate | |

| #8 | $81 | A+ | Road Assistance | Nationwide |

| #9 | $100 | A | Local Agents | Liberty Mutual |

| #10 | $105 | A+ | Affordable Options | Erie |

Whether you’re a student, senior, or safe driver looking for savings, this guide will help you secure the cheapest auto insurance without sacrificing protection.

Read More:

Ready to buy Rhode Island auto insurance? Before reading our ultimate Rhode Island auto insurance guide for your area, enter your ZIP code in the box above. Find the best Rhode Island auto insurance rates today.

- Compare top insurers like State Farm, Travelers, and Progressive for the best rates.

- Use online tools to find discounts and the cheapest coverage options.

- Factors like driving history, credit score, and location impact your premium.

#1 – State Farm: Top Overall Pick

Pros

Pros

- Affordable Rates: Offers cheap auto insurance in Rhode Island, with rates as low as $32 a month. Read more in our full review on State Farm’s auto insurance

- Multiple Discounts: Save more with safe driver, bundling, and student discounts.

- Strong Customer Support: 24/7 claims assistance and a large network of local agents.

- User-Friendly App: Easy policy management, bill payments, and claim filing on the go.

Cons

- Limited High-Risk Coverage: They may not offer the cheapest rates for drivers with accidents or violations.

- Fewer Customization Options: Limited add-ons compared to some competitors.

- No Gap Insurance: Does not offer gap coverage, which may be needed for financed vehicles.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Cheapest Rates for Coverage

Pros

- Competitive Rates: Travelers offers cheap auto insurance in Rhode Island, starting at $44 a month. Read our review of Travelers to learn more.

- Strong Discount Options: Save with multi-policy, safe driver, and hybrid vehicle discounts.

- Accident Forgiveness: Helps prevent rate increases after your first accident.

- Customizable Coverage: This offers optional add-ons like roadside assistance and new car replacement.

Cons

- Higher Base Rates: Starting premiums can be higher than those of some competitors, like State Farm.

- Limited Local Agents: Fewer in-person offices compared to major insurers.

- Mixed Customer Reviews: Some customers report slow claims processing.

#3 – Progressive: Cheapest Rates for Coverage Options

Pros

Pros

- Affordable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $49 a month. Our complete Progressive review covers this in more detail.

- Name Your Price Tool: Helps drivers find policies that fit their budget.

- Large Discount Selection: Save with multi-policy, good driver, and online quote discounts.

- Strong Digital Experience: Easy online quotes, policy management, and claims filing.

Cons

- Higher Rates for High-Risk Drivers: This can be expensive for those with accidents or violations.

- Customer Service Varies: Some policyholders report inconsistent support experiences.

- Limited Local Agent Support: Primarily online-based, with fewer in-person agent options.

#4 – Geico: Employee Discounts

Pros

- Affordable Rates: Offers cheap auto insurance in Rhode Island, starting at $53/month. Learn more about Geico’s rates in our Geico auto insurance company review.

- Generous Discounts: Save with military, federal employee, multi-policy, and safe driver discounts.

- Easy Online Access: User-friendly app and website for quotes, claims, and policy management.

- Strong Financial Stability: Reliable claims handling with a solid industry reputation.

Cons

- Limited Local Agents: Fewer in-person support options compared to competitors like State Farm.

- Higher Rates for High-Risk Drivers: This can be expensive for those with poor driving records.

- Fewer Customization Options: Limited add-ons compared to other insurers.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Cheapest for Loyalty Savings

Pros

Pros

- Competitive Pricing: The company offers cheap auto insurance in Rhode Island, starting at $64 a month. Find out more about American Family in our American Family review.

- Excellent Discount Options: Save with bundling, loyalty, good student, and safe driver discounts.

- Strong Customer Service: High-rated support with local agents available for assistance.

- Customizable Coverage: This offers add-ons like accident forgiveness and roadside assistance.

Cons

- Higher Base Rates: Starting premiums are higher than competitors like State Farm and Geico.

- Limited Availability: Fewer locations and agents compared to major national insurers.

- Slower Claims Processing: Some customers report delays in handling claims.

#6 – Farmers: Cheapest for Family Drivers

Pros

Pros

- Reliable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $78 a month. Read our Farmers Insurance company review to learn more.

- Diverse Discount Options: Save with bundling, good driver, multi-car, and professional group discounts.

- Strong Local Agent Network: Provides personalized service with in-person support.

- Customizable Policies: Offers unique add-ons like new car replacement and accident forgiveness.

Cons

- Higher Starting Rates: More expensive than competitors like State Farm and Geico.

- Mixed Customer Reviews: Some policyholders report issues with claims handling and rate increases.

- Limited Digital Experience: Online tools are less advanced compared to Geico or Progressive.

#7 – Allstate: Cheapest For Detailed Coverage

Pros

Pros

- Reliable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $80 a month. Read more about this provider in our Allstate auto insurance review.

- Many Discount Options: Save with bundling, safe driver, new car, and multi-policy discounts.

- Strong Local Agent Support: Personalized service with in-person assistance available.

- Comprehensive Add-Ons: These offer accident forgiveness, roadside assistance, and new car replacement.

Cons

- Higher Premiums: More expensive than competitors like State Farm and Geico.

- Mixed Customer Satisfaction: Some drivers report high renewal rates and claims delays.

- Strict Eligibility for Discounts: Some discounts require specific conditions to qualify.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Cheapest For Accident Forgiveness

Pros

Pros

- Affordable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $81 a month. You can learn more in our Nationwide auto insurance review.

- Vanishing Deductible: Lower your deductible for every year of safe driving.

- Strong Discount Options: Save with bundling, good driver, and accident-free discounts.

- Comprehensive Coverage Add-Ons: Offers roadside assistance, gap insurance, and accident forgiveness.

Cons

- Higher Base Rates: More expensive than competitors like State Farm and Geico.

- Limited Local Agents: Fewer in-person support options compared to companies like Allstate.

- Strict Eligibility for Some Discounts: Certain discounts require meeting specific criteria.

#9 – Liberty Mutual: Customizable Coverage

Pros

Pros

- Customizable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $ 100 a month. Learn more about this provider in our thorough Liberty Mutual company review.

- Unique Discounts: Save with bundling, good student, and right-track safe driving programs.

- Accident Forgiveness: Prevents premium increases after your first accident.

- Strong Digital Tools: Easy online policy management and claims processing.

Cons

- Higher Premiums: More expensive than competitors like State Farm and Geico.

- Mixed Customer Reviews: Some drivers report high renewal rates and claim delays.

- Discount Eligibility Varies: Some discounts are limited based on driving history or location.

#10 – Erie: Best For Rate Stability Pros

Pros

- Competitive Pricing: The company offers cheap auto insurance in Rhode Island, starting at $105 a month. Read our in-depth Erie auto insurance review to find the best policy for your needs.

- Rate Lock Feature: This keeps your premium stable unless you make policy changes.

- Highly Rated Customer Service: Known for excellent claims handling and support.

- Comprehensive Coverage Options: Includes accident forgiveness and new car replacement.

Cons

- Limited Availability: Fewer agents and offices compared to national competitors.

- Higher Starting Rates: More expensive than insurers like State Farm and Geico.

- Fewer Online Tools: The Digital experience isn’t as advanced as Progressive or Geico.

Average Rhode Island Auto Insurance Coverage and Rates

Looking for cheap auto insurance in Rhode Island? Our top 10 company picks offer affordable rates and great coverage. The table below shows the best options available.

Rhode Island Auto Insurance Monthly Rates by Provider & Coverage Level

First, we want to make sure you understand the different types of auto insurance coverage. After all, no one wants to pay for something (or invest in something) if they don’t understand why they need to have it in the first place.

Understanding your coverage options ensures you’re protected without overpaying—know the difference between liability, no-fault, and full coverage.

Chris Abrams Licensed Insurance Agent

Let’s start with the basics: auto insurance types, companies, and special discounts. We want to explain minimum liability coverage and the difference between no-fault and at-fault insurance. Keep reading to find out more.

Auto Insurance Costs in Rhode Island

In Rhode Island, finding affordable auto insurance, especially in cities like Pawtucket, Providence, and Warwick, is crucial for drivers. This guide explores factors influencing insurance costs and offers insights into securing the cheapest options in each city.

| Find the Cheapest Insurance in Your City |

|---|

| Pawtucket, RI |

| Providence, RI |

| Warwick, RI |

Whether you’re a seasoned or new driver, understanding these costs empowers you to make informed decisions to protect yourself and your vehicle.

Percentage of Income Spent on Premiums in Rhode Island

Ever heard of the term “insurance premium”? This is the total amount of money a driver will spend on auto insurance for over one year. Factors that affect your auto insurance premium include driving history, vehicle type, location, and coverage level.

If you’re a new resident or new driver in Rhode Island, you might be interested in knowing the average premium compared to the average resident’s income. Check State Farm’s site to see how premiums compare to income and find cheap coverage options.

Rhode Island’s average per capita income in 2014 was $42,585, and the average auto insurance rate was $1,257.40.

Rhode Islanders spend 2.95 percent of their total annual income on auto insurance.

Surrounding states like Massachusetts and Connecticut have significantly higher average incomes — about $10,000 more than Rhode Island — but surprisingly, the average rates are about the same.

When compared to the rest of the country, the average American has an income of just over $40,000 and pays an average auto insurance rate of $981.

Impact of Gender and Age on Auto Insurance in Rhode Island

Usually, people assume women have higher insurance rates than men, but this is often not the case.

Auto Insurance Monthly Rates in Rhode Island by Provider, Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $258 | $271 | $214 | $220 | $190 | $200 | $160 | $170 | |

| $178 | $210 | $148 | $150 | $135 | $145 | $115 | $125 | |

| $97 | $101 | $76 | $78 | $65 | $70 | $50 | $55 |

| $246 | $256 | $171 | $183 | $160 | $170 | $130 | $140 | |

| $138 | $133 | $104 | $106 | $90 | $95 | $75 | $80 | |

| $267 | $306 | $211 | $227 | $190 | $200 | $165 | $175 |

| $194 | $213 | $141 | $149 | $125 | $135 | $110 | $120 |

| $201 | $209 | $131 | $136 | $115 | $125 | $95 | $105 | |

| $144 | $158 | $108 | $108 | $95 | $100 | $80 | $85 | |

| $152 | $165 | $127 | $129 | $110 | $120 | $95 | $100 |

Normally, men pay more for auto insurance than women do. For example, Progressive auto insurance in Rhode Island charges men more for auto insurance when drivers are younger but charges more for women once drivers get older.

It may seem odd that factors like marital status and gender play a role in an auto insurance rate, but they do. Factors that affect your auto insurance rates include age, driving history, and location.

Age as a factor, on the other hand, is completely understandable. Usually, the older you get, the lower your policy will be. Auto insurance companies know that with age comes experience, and you’re less likely to be in an accident or get a ticket when you’re 25 than when you’re 16.

Cheapest Rates by ZIP Code in Rhode Island

Did you know that where you live plays a role when deciding your auto insurance rate? Some cities have more accidents than others. Injuries are more likely to happen in some places than others.

Auto insurance companies have access to these statistics, and that’s why they need to know not only where you live but where you drive. Comparing rates by ZIP code can help you find the best deal. Look for your ZIP code in the table below.

Auto Insurance Monthly Rates in Rhode Island by ZIP Code

| City | ZIP | Monthly Rates | Allstate | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Middletown | 2842 | $326 | $326 | $324 | $437 | $289 | $333 | $170 | $428 | $298 |

| Newport | 2840 | $329 | $327 | $324 | $437 | $293 | $333 | $170 | $472 | $280 |

| Jamestown | 2835 | $331 | $326 | $324 | $436 | $289 | $333 | $170 | $487 | $280 |

| Newport | 2841 | $333 | $339 | $324 | $437 | $293 | $333 | $170 | $472 | $298 |

| Little Compton | 2837 | $336 | $335 | $324 | $436 | $311 | $373 | $170 | $456 | $280 |

| Westerly | 2891 | $338 | $354 | $344 | $479 | $308 | $333 | $174 | $402 | $311 |

| Portsmouth | 2871 | $343 | $345 | $340 | $436 | $336 | $333 | $170 | $491 | $291 |

| Block Island | 2807 | $344 | $350 | $344 | $479 | $285 | $333 | $174 | $486 | $299 |

| Tiverton | 2878 | $348 | $339 | $340 | $437 | $321 | $373 | $170 | $500 | $307 |

| Prudence Island | 2872 | $352 | $345 | $324 | $436 | $336 | $422 | $170 | $491 | $291 |

| Wood River Junction | 2894 | $353 | $357 | $378 | $479 | $318 | $333 | $174 | $451 | $337 |

| Kenyon | 2836 | $355 | $325 | $378 | $479 | $318 | $333 | $174 | $494 | $337 |

| Wyoming | 2898 | $355 | $367 | $378 | $479 | $318 | $333 | $174 | $457 | $337 |

| Narragansett | 2882 | $355 | $354 | $413 | $459 | $309 | $333 | $170 | $475 | $330 |

| Bradford | 2808 | $355 | $373 | $378 | $479 | $302 | $333 | $174 | $486 | $318 |

| Charlestown | 2813 | $356 | $384 | $413 | $479 | $302 | $333 | $174 | $429 | $332 |

| Wakefield | 2879 | $357 | $362 | $413 | $459 | $309 | $333 | $170 | $477 | $330 |

| Hope Valley | 2832 | $357 | $360 | $378 | $479 | $313 | $333 | $174 | $485 | $337 |

| Ashaway | 2804 | $358 | $362 | $378 | $479 | $313 | $333 | $174 | $485 | $337 |

| Shannock | 2875 | $360 | $370 | $378 | $479 | $302 | $333 | $174 | $527 | $320 |

| Kingston | 2881 | $362 | $347 | $413 | $459 | $309 | $439 | $170 | $436 | $320 |

| Hopkinton | 2833 | $363 | $362 | $378 | $479 | $313 | $333 | $174 | $527 | $337 |

| West Kingston | 2892 | $364 | $367 | $413 | $459 | $309 | $333 | $174 | $533 | $320 |

| Rockville | 2873 | $371 | $365 | $378 | $479 | $358 | $333 | $174 | $528 | $350 |

| Carolina | 2812 | $372 | $356 | $378 | $479 | $302 | $439 | $174 | $507 | $337 |

| Saunderstown | 2874 | $372 | $398 | $413 | $459 | $358 | $333 | $170 | $528 | $320 |

| Briston | 2809 | $381 | $393 | $461 | $436 | $345 | $422 | $170 | $476 | $348 |

| Exeter | 2822 | $383 | $399 | $378 | $479 | $367 | $439 | $174 | $491 | $340 |

| North Kingstown | 2852 | $385 | $392 | $380 | $459 | $358 | $427 | $170 | $560 | $337 |

| Pascoag | 2859 | $386 | $390 | $475 | $479 | $320 | $391 | $174 | $499 | $362 |

| Harrisville | 2830 | $388 | $404 | $426 | $479 | $320 | $391 | $174 | $550 | $362 |

| Mapleville | 2839 | $389 | $402 | $426 | $479 | $320 | $391 | $174 | $562 | $362 |

| Glendale | 2826 | $391 | $410 | $426 | $479 | $320 | $391 | $174 | $564 | $361 |

| North Smithfield | 2896 | $393 | $399 | $426 | $467 | $332 | $391 | $228 | $558 | $341 |

| Warren | 2885 | $393 | $375 | $461 | $536 | $331 | $422 | $170 | $502 | $348 |

| Oakland | 2858 | $393 | $393 | $426 | $479 | $320 | $391 | $241 | $534 | $362 |

| Slocum | 2877 | $394 | $404 | $413 | $459 | $358 | $427 | $174 | $564 | $350 |

| Slatersville | 2876 | $394 | $406 | $426 | $467 | $332 | $391 | $241 | $534 | $358 |

| Adamsville | 2801 | $395 | $352 | $324 | $436 | $289 | $821 | $170 | $487 | $280 |

| Barrington | 2806 | $397 | $424 | $433 | $479 | $373 | $422 | $170 | $530 | $348 |

| Forestdale | 2824 | $397 | $402 | $426 | $437 | $356 | $391 | $241 | $564 | $361 |

| Woonsocket | 2895 | $398 | $393 | $453 | $499 | $333 | $391 | $228 | $545 | $341 |

| West Greenwich | 2817 | $399 | $406 | $468 | $459 | $363 | $439 | $174 | $536 | $348 |

| Greene | 2827 | $402 | $426 | $468 | $459 | $372 | $439 | $174 | $518 | $358 |

| Cumberland | 2864 | $403 | $428 | $468 | $499 | $339 | $391 | $228 | $479 | $391 |

| Coventry | 2816 | $404 | $409 | $468 | $459 | $372 | $439 | $174 | $559 | $348 |

| Manville | 2838 | $407 | $406 | $426 | $467 | $360 | $439 | $228 | $536 | $391 |

| Chepachet | 2814 | $407 | $406 | $475 | $479 | $351 | $448 | $174 | $557 | $365 |

| Albion | 2802 | $411 | $401 | $496 | $437 | $351 | $439 | $241 | $557 | $361 |

| Foster | 2825 | $414 | $417 | $512 | $479 | $356 | $448 | $174 | $564 | $361 |

| Peace Dale | 2883 | $415 | $340 | $413 | $459 | $309 | $821 | $170 | $475 | $330 |

| East Greenwich | 2818 | $417 | $417 | $432 | $499 | $393 | $427 | $228 | $590 | $348 |

| North Scituate | 2857 | $420 | $455 | $512 | $479 | $375 | $439 | $174 | $561 | $361 |

| Harmony | 2829 | $428 | $455 | $475 | $479 | $367 | $448 | $241 | $603 | $358 |

| Greenville | 2828 | $428 | $477 | $476 | $479 | $367 | $439 | $228 | $603 | $358 |

| Hope | 2831 | $430 | $446 | $512 | $479 | $375 | $439 | $174 | $595 | $418 |

| West Warwick | 2893 | $430 | $442 | $510 | $536 | $374 | $427 | $228 | $583 | $341 |

| Clayville | 2815 | $431 | $431 | $512 | $479 | $375 | $439 | $241 | $598 | $369 |

| Warwick | 2886 | $431 | $423 | $464 | $536 | $391 | $439 | $228 | $593 | $377 |

| Lincoln | 2865 | $436 | $441 | $496 | $504 | $360 | $439 | $228 | $627 | $391 |

| Fiskeville | 2823 | $437 | $429 | $626 | $479 | $356 | $439 | $241 | $564 | $361 |

| Smithfield | 2917 | $438 | $429 | $476 | $479 | $367 | $590 | $228 | $574 | $358 |

| Warwick | 2889 | $440 | $435 | $464 | $536 | $391 | $503 | $228 | $597 | $367 |

| Riverside | 2915 | $444 | $427 | $503 | $536 | $362 | $422 | $228 | $682 | $390 |

| Warwick | 2888 | $446 | $440 | $464 | $536 | $391 | $503 | $228 | $634 | $369 |

| Pawtucket | 2861 | $452 | $448 | $508 | $536 | $446 | $422 | $228 | $612 | $416 |

| Rumford | 2916 | $465 | $457 | $638 | $536 | $362 | $422 | $228 | $685 | $393 |

| East Providence | 2914 | $465 | $442 | $503 | $536 | $402 | $590 | $228 | $629 | $390 |

| Providence | 2906 | $490 | $487 | $447 | $748 | $480 | $422 | $241 | $684 | $411 |

| Central Falls | 2863 | $498 | $476 | $638 | $536 | $446 | $553 | $228 | $684 | $422 |

| Cranston | 2920 | $498 | $497 | $626 | $589 | $469 | $503 | $228 | $654 | $418 |

| Cranston | 2921 | $503 | $495 | $626 | $589 | $469 | $503 | $228 | $700 | $418 |

| Johnston | 2919 | $508 | $486 | $626 | $630 | $457 | $439 | $228 | $727 | $475 |

| Cranston | 2910 | $509 | $467 | $626 | $630 | $469 | $503 | $228 | $717 | $432 |

| Providence | 2918 | $510 | $429 | $770 | $748 | $367 | $589 | $241 | $574 | $358 |

| Providence | 2912 | $515 | $481 | $447 | $748 | $478 | $553 | $241 | $764 | $411 |

| Pawtucket | 2860 | $519 | $475 | $638 | $536 | $454 | $553 | $228 | $828 | $438 |

| North Providence | 2911 | $528 | $481 | $626 | $630 | $478 | $568 | $228 | $764 | $453 |

| Providence | 2903 | $530 | $568 | $447 | $748 | $532 | $503 | $241 | $789 | $411 |

| Providence | 2904 | $539 | $480 | $669 | $748 | $478 | $568 | $241 | $701 | $425 |

| Providence | 2905 | $577 | $569 | $626 | $748 | $532 | $503 | $241 | $912 | $483 |

| Providence | 2908 | $588 | $561 | $770 | $748 | $532 | $589 | $241 | $840 | $425 |

| Providence | 2909 | $603 | $550 | $770 | $748 | $579 | $589 | $241 | $922 | $425 |

| Providence | 2907 | $605 | $548 | $770 | $748 | $532 | $589 | $241 | $964 | $448 |

The cheapest ZIP code in Rhode Island is 02842, which is over twice as cheap as the most expensive ZIP code, 02907. Be sure to compare car insurance rates by ZIP code to find the most affordable coverage in your area.

Read More: Cheap auto insurance rates

Cheapest Rates by City in Rhode Island

Now, let’s look at how the cities in Rhode Island compare to each other.

Auto Insurance Monthly Rates in Rhode Island by City

| City | Rates |

|---|---|

| Middletown | $326 |

| Jamestown | $331 |

| Newport | $331 |

| Little Compton | $336 |

| Westerly | $338 |

| Portsmouth | $343 |

| Block Island | $344 |

| Tiverton | $348 |

| Prudence Island | $352 |

| Wood River Junction | $353 |

| Kenyon | $355 |

| Wyoming | $355 |

| Narragansett | $355 |

| Bradford | $355 |

| Charlestown | $356 |

| Wakefield | $357 |

| Hope Valley | $357 |

| Ashaway | $358 |

| Shannock | $360 |

| Kingston | $362 |

| Hopkinton | $363 |

| West Kingston | $364 |

| Rockville | $371 |

| Carolina | $372 |

| Saunderstown | $372 |

| Bristol | $381 |

| Exeter | $383 |

| North Kingstown | $385 |

| Pascoag | $386 |

| Harrisville | $388 |

| Mapleville | $389 |

| Glendale | $391 |

| North Smithfield | $393 |

| Warren | $393 |

| Oakland | $393 |

| Slocum | $394 |

| Slatersville | $394 |

| Adamsville | $395 |

| Barrington | $397 |

| Forestdale | $397 |

| Woonsocket | $398 |

| West Greenwich | $399 |

| Greene | $402 |

| Cumberland | $403 |

| Coventry | $404 |

| Manville | $407 |

| Chepachet | $407 |

| Albion | $411 |

| Foster | $414 |

| Peace Dale | $415 |

| East Greenwich | $417 |

| North Scituate | $420 |

| Harmony | $428 |

| Greenville | $428 |

| Hope | $430 |

| West Warwick | $430 |

| Clayville | $431 |

| Lincoln | $436 |

| Fiskeville | $437 |

| Smithfield | $438 |

| Warwick | $439 |

| Riverside | $444 |

| Rumford | $465 |

| East Providence | $465 |

| Pawtucket | $485 |

| Central Falls | $498 |

| Cranston | $503 |

| Johnston | $508 |

| North Providence | $528 |

| Providence | $551 |

Providence is the biggest city in Rhode Island, so it makes sense that auto insurance in Providence, RI, is the most expensive there. However, cheap rates for auto insurance can be found in smaller towns like Westerly, Rhode Island, where insurance costs are lower due to fewer accidents and lower population density.

Impact of Commute on Auto Insurance Rates in Rhode Island

How far you drive every day can also affect your rate.

Auto Insurance Monthly Rates in Rhode Island by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $140 | $150 | |

| $130 | $140 | |

| $110 | $120 |

| $135 | $145 | |

| $100 | $110 | |

| $145 | $155 |

| $125 | $135 |

| $120 | $130 | |

| $115 | $125 | |

| $128 | $138 |

For most of the companies listed, the average car insurance costs in Rhode Island remain very similar regardless of the distance traveled. Some companies don’t charge any extra, but Geico and Liberty Mutual charge hundreds of dollars more based on commute.

You can also use online comparison tools to find the best rates based on your commute and driving habits.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Coverage Level and Its Effect on Auto Insurance Rates in Rhode Island

Sometimes, auto insurance companies will give you a break on your policy if you have more insurance than the minimum that is required.

Auto Insurance Monthly Rates in Rhode Island by Coverage Level

| Insurance Company | High | Med | Low |

|---|---|---|---|

| $160 | $140 | $125 | |

| $150 | $135 | $120 | |

| $130 | $115 | $100 |

| $155 | $140 | $125 | |

| $120 | $110 | $95 | |

| $165 | $145 | $130 |

| $140 | $125 | $110 |

| $135 | $120 | $105 | |

| $145 | $130 | $115 | |

| $148 | $133 | $118 |

Although you will pay more upfront, the extra coverage will give you peace of mind in the event of an accident. Types of auto insurance coverage include liability, comprehensive, collision, and uninsured/underinsured motorist protection, all of which can impact your premium.

Credit History and Its Impact on Auto Insurance Rates in Rhode Island

Credit can also play a role when it comes to auto insurance rates. If you have poor credit, your rates will most likely be extremely high.

Rhode Island residents have an average credit score of 687.

Collectively, the average credit score in the U.S. is 675, so Rhode Island’s average score is 13 points higher than the national average.

Rhode Island Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $135 | $150 | $190 | |

| $125 | $140 | $180 | |

| $110 | $125 | $165 |

| $130 | $145 | $185 | |

| $100 | $115 | $160 | |

| $145 | $160 | $210 |

| $120 | $135 | $175 |

| $115 | $130 | $170 | |

| $125 | $140 | $185 | |

| $128 | $143 | $188 |

How Your Credit Score Affects Your Auto Insurance Premiums—Keep your credit report in good standing, and your auto insurance rates will most likely stay lower. On the other hand, if you have poor credit, you could be paying thousands of dollars more per year for your auto insurance policy.

Driving Record and Its Effect on Auto Insurance Rates in Rhode Island

Have you ever gotten a speeding ticket and then noticed your auto insurance policy increased? That’s because your driving record is probably the most influential factor when determining auto insurance rates.

Rhode Island Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $130 | $150 | $170 | $220 | |

| $120 | $140 | $160 | $210 | |

| $110 | $130 | $150 | $200 |

| $125 | $145 | $165 | $215 | |

| $100 | $120 | $140 | $190 | |

| $140 | $160 | $180 | $230 |

| $115 | $135 | $155 | $205 |

| $118 | $138 | $158 | $208 | |

| $122 | $142 | $162 | $212 | |

| $128 | $148 | $168 | $218 |

Check out Geico’s rates. If you go from having a clean record to getting one DUI, your yearly premium will increase by over $6,000. Not only can drinking and driving cost you thousands of dollars in fines, but it can also cost you thousands of dollars in auto insurance. Several key factors influence your auto insurance rates, including your driving record in RI, age, credit score, and location.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rhode Island Minimum Coverage Requirements

By law, every driver must have minimum liability Rhode Island auto insurance requirements. This coverage protects drivers if and when an accident occurs.

Having liability insurance ensures a driver is financially covered and is able to cover the costs of any damages resulting from an accident — to his own vehicle and anyone else’s. That’s right; this means Rhode Island is an at-fault state.

In Rhode Island, any person who causes an accident is responsible for covering the costs of damages to all parties involved.

It seems simple and fair, doesn’t it? While Rhode Island is one of 38 states to claim the at-fault title, 12 states in the U.S. are considered to be no-fault states. Check the Travelers site to learn more about at-fault and no-fault insurance policies.

Rhode Island auto insurance requirements are:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

Remember, in the grand scheme of car values and costs, these amounts aren’t that high. Insurance money runs out fast, so it’s good to carry more than the Rhode Island minimum auto insurance coverage.

SR-22 Insurance Requirements

High-risk insurance (or SR-22 insurance) is required by any and all drivers who are convicted of a DUI. SR-22 auto insurance is a type of high-risk auto insurance policy issued by an insurance provider that reassures and warranties the Rhode Island Department of Motor Vehicles that the policyholder, as required by the state law, has the minimum insurance coverage.

There are multiple SR-22 insurance companies in Rhode Island.

Besides getting a DUI, here are some other reasons you might need to get SR-22 insurance:

- Anyone with one or more DUIs on their record

- Multiple ticket violations

- Anyone caught driving without insurance coverage

- Being uninsured at the time of an accident

- Being unable to verify insurance coverage for a random state verification request

If you need SR-22 insurance, some providers can refuse you as a client because you are considered a “high-risk” driver.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Financial Responsibility in Rhode Island

Because every driver in Rhode Island is required to carry minimum liability insurance, every driver is also required to carry a form of financial responsibility or proof of insurance.

This is a document you will receive after you have purchased an auto insurance policy. If a law enforcement officer asks to see proof of insurance, you can show them any of the following documents:

- Valid liability insurance ID cards

- Electronic insurance ID card

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of auto insurance)

Driving without proof of insurance (or proof of financial responsibility) in Rhode Island is a misdemeanor.

Rhode Island residents who do not carry proof of insurance can face fines of up to $1,000, and a license suspension of up to 12 months.

If you’re caught driving without proof of insurance, you may be required to get SR-22 insurance. This type of insurance may raise your auto insurance rates. Cheap Auto Insurance from top providers can help you find affordable coverage, even if you need an SR-22.

Core Coverages in Rhode Island

Let’s look at the average monthly rates based on coverage for Rhode Island.

Rhode Island Auto Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Liability | Collision | Comprehensive | Full Coverage |

|---|---|---|---|---|

| $110 | $140 | $30 | $160 | |

| $100 | $130 | $28 | $150 | |

| $90 | $120 | $25 | $140 |

| $105 | $135 | $27 | $155 | |

| $85 | $110 | $22 | $130 | |

| $115 | $145 | $32 | $165 |

| $95 | $125 | $26 | $145 |

| $98 | $128 | $27 | $148 | |

| $102 | $132 | $28 | $152 | |

| $104 | $134 | $29 | $154 |

The data above comes directly from the National Association of Insurance Commissioners (NAIC), but because this data was pulled in 2015, insurance costs are likely to be higher today.

Though it is tempting to purchase only the minimum insurance required, it is important to have the right coverage to fully suit your needs and your vehicle.

Up next, we will talk about additional coverage options.

Additional Liability Available in Rhode Island

Let’s say you get hit by an uninsured driver, and your car is totaled. You have medical bills up to your eyes. Most likely, that uninsured driver will go bankrupt trying to pay for these costs, and you will never see a dime of money that was rightfully owed to you. This is where uninsured insurance comes into play.

But what exactly is a loss ratio? A loss ratio is how we determine a company’s financial strength. By knowing these percentages, we can figure out how many filed claims were paid out by an insurance company and how many claims were not paid.

Rhode Island Auto Insurance Loss Ratios

| Loss Ratio | 2012 Percentage | 2013 Percentage | 2014 Percentage |

|---|---|---|---|

| Medical Payments (MedPay) | 99.07% | 100.17% | 97.52% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 69.26% | 63.74% | 63.43% |

At least 7.60 percent of Rhode Island drivers are uninsured. Uninsured and medical payment insurance are additional insurance options, but drivers are not required to carry these add-ons by law. Though it’s not required, it still might be a good idea to have these types of insurance.

Rhode Island is ranked 43rd in the U.S. for uninsured drivers.

By looking at the table above, we know that insurance companies in Rhode Island paid about 69 percent of uninsured insurance claims filed from 2012-14. If this number was too high (over 100 percent), these companies may have been at risk of going bankrupt because they were paying too many claims—some of these claims may even have been fraudulent.

On the other hand, if the number was too low (under 50 percent), these companies may have been scamming clients because they were only paying about half of the claims received.

Uninsured drivers are a risk—protect yourself with uninsured motorist coverage to avoid paying out-of-pocket after an accident.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

So what should you look for when finding a new insurance company? Avoid auto insurance companies with low and high loss ratios. Stick with companies that have loss ratios of 50-90 percent. If your current rates are too high, you may want to switch providers to a company with the cheapest pricing and coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Add-ons, Endorsements, and Riders Available in Rhode Island

There are many auto insurance add-on options out there. But how do you know which ones are right for you? There are many different types of auto insurance coverage. A few of them are:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Auto Insurance

- Modified Auto Insurance Coverage

- Classic Auto Insurance

- Pay-As-You-Drive or Usage-Based Insurance

This video shows you many of the coverage options that are available.

You don’t have to choose just one policy from this list. Add one or add them all. The decision is completely up to you.

Low-Cost Insurance

Unfortunately, Rhode Island does not have an insurance program for families with low income; however, there are more ways to save money on your auto insurance policy. When you’re signing up with a new insurance company, always ask for these discounts:

- Homeowner’s discount

- Good Driver discount

- Student discount

- Multi-car discount

- Military discount

Speak with your provider to see if you qualify for discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Top auto insurance providers in Rhode Island offer discounts for safe driving, bundling, and more to help lower your premium. The table below outlines the best discounts available.

Auto Insurance Discounts From the Top Providers in Rhode Island

Auto insurance discounts in Rhode Island can significantly reduce your overall costs, making coverage more affordable.

Best Rhode Island Auto Insurance Companies

With hundreds of auto insurance companies out there, it’s difficult to choose just one to insure you and your vehicle. How do you know if your claims will be paid when you get into an accident? Does the company have good customer service ratings?

Don’t worry—we’ve done the research for you! In this section, we compare companies‘ financial ratings, A.M. Best ratings, and complaint records, helping you find a reliable insurer with confidence.

Financial Ratings of the Largest Auto Insurance Companies in Rhode Island

The financial strength of an insurance company is very important. Let’s examine some of the companies in Rhode Island to see how their financial ratings stack up. In the table above, we show A.M. Best’s ratings.

Financial Ratings of Rhode Island's Largest Auto Insurance Companies

| Companoes | AM Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Allstate Insurance Group | A+ | $107,256 | 62.08% | 11.63% |

| Amica Mutual Group | A+ | $105,708 | 63.36% | 11.47% |

| Geico | A++ | $109,611 | 79.71% | 11.89% |

| Liberty Mutual Group | A | $65,124 | 65.17% | 7.06% |

| Mapfre Insurance Group | A | $42,523 | 63.64% | 4.61% |

| Metropolitan Group | A | $55,075 | 57.15% | 5.97% |

| Nationwide Corp Group | A+ | $52,881 | 63.34% | 5.74% |

| Progressive Group | A+ | $193,720 | 65.71% | 21.01% |

| Travelers Group | a+ | $21,853 | 54.69% | 2.37% |

| USAA Group | A++ | $63,851 | 78.38% | 6.93% |

A.M. Best ratings measure a company’s financial strength. As mentioned previously, a company shouldn’t have a loss ratio of over 100 percent or under 50 percent. All the companies above have great loss ratio percentages and very good ratings.

Auto Insurance Companies With the Best Ratings in Rhode Island

People don’t know how important customer service is to auto insurance companies until they’re standing on the side of the road after an accident trying to explain what happened over the phone to a customer service representative.

With the exception of USAA, Amica Mutual was ranked as the best company for customer service in 2018. Evaluating and comparing auto insurance providers can help you find a company with top-rated customer support.

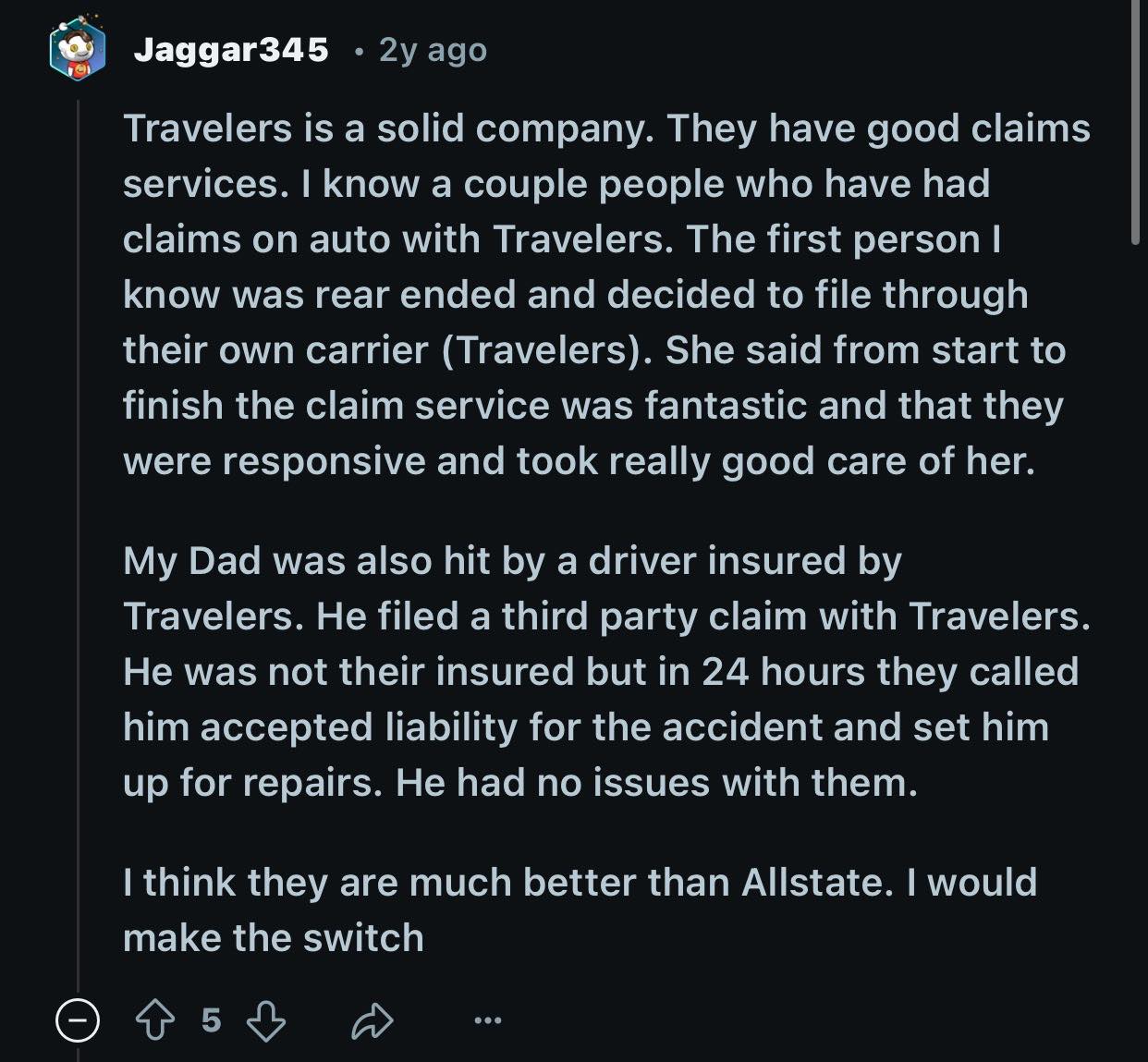

The Reddit post below states that Travelers provides excellent claims service, whether you’re their policyholder or filing a third-party claim.

With competitive rates and reliable service, Travelers is a great option for affordable auto insurance in Rhode Island.

Auto Insurance Companies With the Most Complaints in Rhode Island

The data below is pulled from the NAIC. It includes complaint statistics for the top 10 largest auto insurance companies in Rhode Island.

Complaints for Rhode Island Auto Insurance Companies

| Companoes | National Median Complaint Ratio | Company Complaint Ratio (2017) | Total Complaints (2017) |

|---|---|---|---|

| Allstate Insurance Group | 1 | 0.5 | $163.00 |

| Amica Mutual Group | 1 | 0.46 | $52 |

| Geico | N/A | 0.007 | $6 |

| Liberty Mutual Group | 1 | 5.95 | $222 |

| Mapfre Insurance Group | 1 | 6.25 | $27 |

| Metropolitan Group | 1 | 1.3 | $70 |

| Nationwide Corp Group | 1 | 0.28 | $25 |

| Progressive Group | 1 | 0.75 | $120 |

| Travelers Group | 1 | 0.09 | $2 |

| USAA Group | N/A | 0 | $2 |

Every company receives complaints at some point or another. What you should really be aware of is how a company handles a complaint. These companies are some of the best in the country, and even though they have received complaints, they are still very highly recommended.

Cheapest Auto Insurance Companies in Rhode Island

This table lists some of the rates of auto insurance companies in Rhode Island compared to the state average.

Rhode Island Auto Insurance Monthly Rates by Company vs. State Average

| Insurance Company | Monthly Rates | Rates Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| $135 | +10 | +8% | |

| $120 | -$5 | -4% | |

| $105 | -$20 | -16% |

| $130 | +$5 | +4% | |

| $100 | -$25 | -20% | |

| $140 | +$15 | +12% |

| $125 | $0 | 0% |

| $115 | -$10 | -8% | |

| $110 | -$15 | -12% | |

| $128 | +$3 | +2% |

Besides USAA, which only serves military members and their families, State Farm auto insurance has the cheapest premium in Rhode Island.

Auto Insurance Companies Available in Rhode Island

Just how many licensed insurance companies are there in Rhode Island? Let’s take a look at the data.

Number of Licensed Auto Insurance Companines in Rhode Island

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 22 | 727 | 749 |

In total, there are 749 licensed insurance companies in Rhode Island. But what is the difference between foreign and domestic insurance?

Domestic insurance laws are formed under state law. Foreign insurance laws are formed under the laws the U.S. Foreign insurance is applicable to any state in the U.S.

Some agencies, like HiRoad Insurance in Rhode Island, are part of a larger company. For example, HiRoad is part of the State Farm family. You can also use online comparison tools to find the cheapest rates and identify the best insurance providers for your needs.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rhode Island Laws

Sometimes, it’s difficult to know all of the laws ever written that apply to you and your driving, especially in a state as small as Rhode Island, where drivers are constantly crossing over state lines.

No one wants to get fined for disobeying a driving law, so to help you avoid the headache and the fines, we want to make sure you are aware of driving laws specific to Rhode Island.

Remember how we mentioned that just one speeding violation could significantly increase your insurance rates? The same principle applies to most traffic infractions. Essential safe driving practices can help you stay compliant and keep your rates low.

Auto Insurance Laws in Rhode Island

By now, you should know that every driver in Rhode Island must carry minimum liability coverage at all times. If you decide to drive without this insurance, your license could be suspended, and you could be charged with a misdemeanor.

But how are these laws written into practice?

According to the NAIC, Rhode Island auto insurance laws have a considerable influence on auto insurance. Each state determines the type of tort law and threshold (if any) that applies in the state, the type and amount of liability insurance required, and the system used for approval of insurer rates and forms.

Rhode Island uses what’s called “flex rating” and “prior approval” when approving an individual’s insurance rate.

- Flex rating: Rates must be approved prior to filing only if they exceed a certain percentage above (and sometimes below) the previously filed rates.

- Prior Approval: Rates/forms must be filed with and approved by the state insurance department before they can be used. A deemer provision indicates approval if rates/forms are not denied within a specified number of days.

Windshield Coverage

Although there aren’t any specific laws regarding insurance companies paying to have a broken windshield replaced, some companies may offer this service with comprehensive coverage.

Check with your auto insurance company to see if you are covered or consider adding comprehensive coverage to your policy. To learn how to choose the right coverage, explore your options carefully and compare policies that fit your needs.

Automobile Insurance Fraud in Rhode Island

Auto insurance fraud is a serious crime in the state of Rhode Island. If convicted, you may face time in prison and have to pay thousands of dollars in fines. As defined by the Insurance Information Institute, insurance fraud can be “hard” or “soft.”

Hard fraud occurs when someone deliberately fabricates claims or fakes an accident.

Soft insurance fraud, also known as opportunistic fraud, occurs when people pad legitimate claims, for example, or, in the case of business owners, list fewer employees or misrepresent the work they do to pay lower premiums for worker’s compensation.

To report fraud in Rhode Island, please call the Fraud Unit at 1-401-574-8175. You can also visit www.dhs.ri.gov to report fraud anonymously.

Statute of Limitations

If you get into a car accident, you have a certain amount of time to file a claim with an auto insurance company. This is called the statute of limitations. The statute of limitations law protects both the client and the insurer.

It protects the client by giving him or her a decent amount of time to file a claim, but it also protects the insurer from receiving a claim many years after an accident has happened.

In the state of Rhode Island, you have three years to file a claim for personal injury and ten years to file a claim for property damage. Rhode Island holds the record for the state with the longest amount of time to file a property damage claim.

Car accidents and auto claims should be addressed promptly, as a decade can pass quickly. If you have any claims, make sure to file them as soon as possible.

Vehicle Licensing Laws in Rhode Island

Now, let’s take a look at some of Rhode Island’s vehicle licensing laws.

REAL ID

By 2020, every driver will be required to carry a REAL ID if they wish to go through security at the airport and board a domestic flight.

The REAL ID Act was created to cut down on identity theft and increase safety for the general public.

Penalties for Driving Without Insurance

You must have auto insurance on any vehicle you drive in the state of Rhode Island. But what are the penalties for driving without auto insurance?

Penalties for Driving Without Auto Insurance in Rhode Island

| Offense | Penalties |

|---|---|

| 1st Offense | - Fine of $100 to $500 - License and registration suspension up to three months - reinstatement fee: $30 to $50 |

| 2nd Offense | - Fine of $500 - license and registration suspension up to six months - reinstatement fee: $30 to $50 |

Even if you really have auto insurance but are caught driving without proof of insurance, your license may still be suspended. Let’s go back to the basics. What is an acceptable form of proof of insurance?

- Electronic insurance ID card

- Original insurance ID card

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of auto insurance)

Rhode Island drivers must carry the required level of auto insurance to legally operate a vehicle in the state.

Teen Driver Laws

According to the IIHS, in Rhode Island, driver education is required of permit applicants younger than 18. However, young drivers can start driver’s education at 16.

Rhode Island Teen Driving Laws

| Teen Driving Laws | Time/Age |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 10 of which must be at night |

| Minimum Age | 16, 6 months |

Auto insurance for teenagers can be expensive, but completing a driver’s education course can get cheap auto insurance.

This video tells you more about what to expect with auto insurance for teens.

Below are the laws for drivers with a restricted license.

Rhode Island Young Driver License Restrictions

| Young Driver Laws | Restrictions |

|---|---|

| Nighttime restrictions | 1 a.m.-5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | No more than 1 passenger younger than 21 |

| Minimum age at which restrictions may be lifted | |

| Nighttime restrictions | 12 months or age 18, whichever occurs first (min. age: 17, 6 mos.) |

| Passenger restrictions | 12 months or age 18, whichever occurs first (min. age: 17, 6 mos.) |

It is important to note that teen drivers have passenger and time restrictions until they meet the age requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Rules of the Road in Rhode Island

As you may know, traffic violations and accumulated points on your driving record can lead to higher auto insurance premiums. But don’t worry! This section will go over Rhode Island’s essential road rules to help you stay informed and avoid penalties.

Fault vs. No-Fault

Rhode Island is an at-fault or “fault” state. This means that anyone who causes an accident is responsible for covering the costs of any damages resulting from that accident, including personal injuries.

In Rhode Island, the at-fault driver pays for damages—having more than minimum coverage can save you from major financial loss.

Daniel Walker Licensed Insurance Agent

Having said that, the person who caused the accident may report a claim with his or her insurance company to help cover the costs of the accident. In the case of this scenario, it’s better to have more insurance than the minimum amount required.

What is the Rhode Island DMV accident report form?

When an accident occurs, the Rhode Island DMV accident form must be filled out and turned in no matter if you are at-fault or not. You can fill it out online or mail in the form. You can access the online form here.

Seatbelt and Car Seat Laws

The state of Rhode Island values keeping all drivers and passengers safe in a moving vehicle. If you’re unsure about these state-specific seatbelt laws, take a look at the table below.

Seat Belt Laws in Rhode Island

| Seat Belt Laws | Details |

|---|---|

| Effective Since | June 18, 1991 |

| Primary Enforcement | yes; effective 6/30/11 |

| Age/Seats Applicable | 18+ years in all seats |

| 1st Offense Max Fine | $40 |

Because the Rhode Island seatbelt law is primary, you can be stopped by the police for not wearing your seatbelt. They do not have to have another reason to stop you.

Adults aren’t the only ones who need to buckle up safely in the car. Children must be in the correct car seat while driving at all times.

Rhode Island Car Seat Rules

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Restraint | Younger than 2 years or less than 30 pounds must be in a rear-facing child restraint |

| Preference for Rear Seat | Children 7 and younger must be in rear seat if available |

| Child Booster Seat | 7 years and younger and less than 57 inches and less than 80 pounds |

| Adult Belt Permissible | 7 years and younger who either weigh 80 pounds or more or who are at least 57 inches tall; 8 through 17 |

The maximum base fine for breaking any of these laws the first time is $85. Additional fees may apply. There are also restrictions against riding in the cargo area of a Pickup truck. You will not be covered by your insurance company in the case of an accident if you are:

- 16 and older

- 15 and younger who are secured in the cargo area

You may not be covered by your insurance in the event of an accident.

Read More: Safe Driving Guidelines

Keep Right and Move Over Laws

We’ve all heard of “keep right or move over laws.” In the state of Rhode Island, drivers are required to keep right if driving slower than the average speed of traffic.

However, state law requires drivers approaching a stationary emergency vehicle displaying flashing lights, including roadside assistance vehicles, traveling in the same direction to vacate the lane closest if safe and possible to do so, and slow to a safe speed. Also included in the law are road maintenance vehicles.

You can also use online comparison tools to shop for the best car insurance rates based on your driving habits and ensure you’re getting the cheapest coverage for your needs.

Speed Limits

Do you know the speed limit laws on every type of road in Rhode Island? If you don’t, you are more likely to be pulled over for a speeding violation. This means your insurance company is likely to raise your rates. Pay attention to the table below, which highlights speed limits in Rhode Island.

Speed Limit Laws in Rhode Island

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 65 mph |

| Urban Interstates | 55 mph |

| Other Limited Access Roads | 55 mph |

| Other Roads | 55 mph |

Obeying the speed limit can help keep your auto insurance rates low. Practicing safe driving habits can also help prevent accidents and keep you and others on the road safe.

Ridesharing

Have you ever heard of Uber or Lyft? If you want to work for a company that offers ridesharing services, you must have ridesharing insurance.

Currently, Geico and Liberty Mutual are the only two companies that offer ridesharing insurance in the state of Rhode Island. Although both Geico and Liberty Mutual have ridesharing insurance, they may have separate requirements for obtaining it.

Automation on the Road

What is automation? According to the IIHS, in driving, automation involves using radar, camera, and other sensors to perform parts or all of the driving tasks on a sustained basis instead of the driver.

Rhode Island does not currently have any laws about automation. But stay tuned because automation in cars is the future of driving.

Learn More:

Safety Laws in Rhode Island

We’ve talked about the rules of the road, but now it’s time to discuss Rhode Island’s safety laws, including the negligent operator system.

What is the negligent operator treatment system? This is a points-based system that assigns points for bad driving behavior and assesses penalties based on the points earned. This can result in fines or license restrictions.

In this section, we will highlight laws regarding DUIs, impaired driving, distracted driving, and more. Let’s start with DUI laws.

DUI Laws

In 2017, there were 34 traffic fatalities in Rhode Island resulting from alcohol-impaired drivers. These 34 lost lives are the reason Rhode Island has such strict drinking and driving laws. Take a look at some of these DUI laws in the table below.

DUI Laws in Rhode Island

| Driving Under the Influence (DUI) Offense | Penalties |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st-2nd non-injury misdemeanors 3rd+ non-injury felony. DUI w/serious bodily injury is felony. |

| Look Back Period | 5 years |

The amount of alcohol you can drink and be under the legal limit will vary based on the type of alcohol and your body type.

What are the penalties for drinking and driving? Penalties include fines, loss of your license, and possible jail time.

DUI Penalties for Rhode Island

| DUI Penalty | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 60 days - 18 months | no minimum, but up to 1 year or 10-60 hours community service | $100-$500 +$500 to hwy assessment fund | possible attendance to treatment program; SR-22 insurance |

| 2nd Offense | 1-2 years | 10 days - 1 year | $400 | mandatory alcohol treatment program, IID for 1-2 years |

| 3rd Offense | 2-3 years | 1-5 years | $400-$5000 +$500 to hwy assessment fund | vehicle may be seized or forfeited, mandatory treatment program, IID for 2 years |

| 4th Offense | Same as 3rd | Same as 3rd | Same as 3rd | Same as 3rd |

As you can see, there are different punishments depending on how many times you break the law and drink and drive.

Read More: Car Insurance After A DUI

Marijuana-Impaired Driving Laws

In Rhode Island, there is a zero-tolerance policy for THC and metabolites. If you get caught doing drugs while driving, you could have your license suspended, face jail time, and have to pay hundreds to thousands of dollars worth of fines.

Even if you aren’t technically doing marijuana while driving and you are consuming a different drug, law enforcement can still convict you of impaired driving.

Before making a risky decision, consider the consequences. Your driving habits and choices play a significant role in determining your auto insurance rates. A conviction for impaired driving will almost certainly lead to a sharp increase in your premiums.

Distracted Driving Laws

Although technology can be wonderful when used appropriately, it can also be life-threatening. Studies have shown that the effects of texting while driving can be worse than those of drinking and driving. Here are the rules about using your cell phone while driving in Rhode Island.

Distracted Driving Laws for Rhode Island

| Distracted Driving Laws | Details |

|---|---|

| Hand-held ban | All drivers |

| Text ban | All drivers |

| Young drivers all cellphone ban | Drivers younger than 18 |

| Enforcement | Primary |

Primary enforcement means any law enforcement officer has the right to pull you over even if he or she suspects you are using your phone inappropriately while driving.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Read More: a href=”https://www.autoinsuranceez.com/road-safety-tips-drivers/”>Ultimate Road Safety Guide (How to Drive Safely)

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Driving in Rhode Island

We’ve covered the safety rules of the road, but now it’s time to discuss Rhode Island’s road risks. We will address topics like vehicle theft, traffic fatalities, traffic congestion, and crash reports.

Being aware of these risks can help you avoid accidents, theft, and even frustrating traffic jams. While having insurance is essential, prevention is just as important. You can also use online comparison tools to find the most affordable coverage while ensuring you stay protected on the road.

Don’t go away—vehicle theft is up first.

Vehicle Theft in Rhode Island

Did you know some vehicles are more frequently stolen than others? Let’s look at some of the more commonly stolen vehicles in Rhode Island.

Vehicle Theft by Make and Model in Rhode Island

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Accord | 1997 | 101 |

| Honda Civic | 1998 | 95 |

| Toyota Camry | 2014 | 69 |

| Nissan Maxima | 2000 | 45 |

| Toyota Corolla | 2014 | 40 |

| Nissan Altima | 2013 | 38 |

| Ford Pickup (Full Size) | 2003 | 36 |

| Jeep Cherokee/Grand Cherokee | 1999 | 32 |

| Honda CR-V | 1999 | 27 |

| Toyota Avalon | 2000 | 18 |

The data above shows the top ten most stolen vehicles in Rhode Island. The year listed is the most popular model stolen. Keep in mind that if your car is stolen, comprehensive coverage insurance will most likely replace it.

Where you live can also affect vehicle theft. The list below, pulled from the FBI, shows the cities in Rhode Island where vehicle theft occurred the most in 2016.

Vehicle Theft by City in Rhode Island

| City | Motor vehicle theft |

|---|---|

| Cranston | 136 |

| Warwick | 75 |

| Woonsocket | 70 |

| Central Falls | 48 |

| Johnston | 47 |

| North Providence | 44 |

| East Providence | 40 |

| Newport | 36 |

| Lincoln | 30 |

| West Warwick | 27 |

| Cumberland | 18 |

| South Kingstown | 16 |

| Westerly | 15 |

| Smithfield | 13 |

| North Kingstown | 10 |

| Tiverton | 9 |

| Middletown | 8 |

| North Smithfield | 8 |

| Bristol | 7 |

| Burrillville | 6 |

| Portsmouth | 6 |

| Warren | 5 |

| Charlestown | 3 |

| East Greenwich | 3 |

| Hopkinton | 3 |

| Narragansett | 3 |

| Scituate | 3 |

| West Greenwich | 3 |

| Barrington | 2 |

| Glocester | 2 |

| Richmond | 2 |

| Foster | 0 |

| Jamestown | 0 |

| Little Compton | 0 |

| New Shoreham3 | 0 |

| Pawtucket4 | |

| Providence3 |

Some of these cities have as few as zero thefts. Cranston has the most vehicle thefts at 136.

Transportation in Rhode Island

Have you ever wondered how many cars your neighbors own? Did you know that how many cars you own can affect your auto insurance rate? If you have multiple cars listed on your policy, you should be able to qualify for a multi-car discount.

Car Ownership

Rhode Island residents own an average of two cars.

Very few residents do not own a car or have five or more vehicles.

Read More: Will my auto insurance cover other cars?

Commute Time

According to Data USA, using averages, Rhode Island employees have a shorter commute time (23.9 minutes) than the normal US worker (25.5 minutes).

Additionally, 2.36 percent of the workforce in Rhode Island have “super commutes” in excess of 90 minutes.

Commuter Transportation

79.4 percent of commuters drove alone to work in 2017. Almost 10 percent carpooled to work.

Very few people took public transportation, walked, or rode a bicycle to work.

Traffic Congestion in Rhode Island

According to TomTom, Providence is the 293rd most traffic-congested city in the world. Not bad!

Traffic Congestion for Rhode Island

| City | World Traffic Rank | Congestion Level on Highways | Average Travel Time |

|---|---|---|---|

| Providence | 293 | 19% | 13 Mins |

The average travel time in Providence is just 13 minutes.

Now that you’ve learned everything about Rhode Island auto insurance, it’s time to start shopping for a great rate. To get started, enter your ZIP code in the box below for affordable quotes.

Frequently Asked Questions

Frequently Asked Questions

Does my location affect my car insurance rate in Rhode Island?

Your location is key in determining your car insurance rates in Rhode Island. Urban areas like Providence typically have higher premiums due to increased traffic congestion, a higher risk of accidents, and elevated vehicle theft rates. In contrast, rural areas like Westerly often have lower rates because of fewer accidents and lower population density. Since location-based pricing varies by ZIP code, comparing quotes from multiple insurers to find the most affordable coverage in your area is essential.

Is minimum coverage sufficient in Rhode Island?

While Rhode Island law requires all drivers to carry minimum liability coverage, it may not be enough to protect you fully in an accident. Since Rhode Island is an at-fault state, the driver responsible for the accident must cover damages, which can quickly exceed minimum coverage limits. While minimum coverage meets legal requirements, increasing your limits or adding extra coverage can prevent financial strain after an accident. Comparing cheap auto insurance in Rhode Island can help you find affordable full coverage options.

Can I get temporary or short-term auto insurance in Rhode Island?

What factors influence auto insurance rates in Rhode Island?

Several factors impact cheap auto insurance in Rhode Island, influencing how much you pay for coverage:

- Driving Record: A clean history leads to lower rates, while violations can increase premiums.

- Location: Urban areas like Providence often have higher insurance costs due to more traffic and accidents.

- Vehicle Type: Standard models are cheaper to insure than luxury or high-performance cars.

- Coverage Level: Minimum liability is the most affordable option but offers less protection than full coverage.

- Age & Experience: Young drivers tend to pay higher rates due to less driving experience.

- Credit History: Many insurers, including State Farm ($32), use credit scores to assess risk and determine premiums.

By considering these factors and comparing quotes, you can find the cheapest auto insurance in Rhode Island that fits your budget and coverage needs.

Read More: Factors that Affect Your Car Insurance

How much does an SR-22 increase my car insurance in Rhode Island?

An SR-22 filing in Rhode Island can significantly increase your car insurance rates because it labels you as a high-risk driver. Depending on the violation—such as a DUI or driving without insurance—premiums can rise by hundreds or even thousands of dollars per year. For example, insurers like Geico may increase rates by over $6,000 after a DUI. However, shopping around and comparing quotes from multiple providers, including State Farm ($32), can help you find more affordable SR-22 insurance options. Taking advantage of discounts and maintaining a clean record moving forward can also help lower costs over time.

Are there specific discounts available for Rhode Island drivers?

Rhode Island drivers can access various car insurance discounts to reduce their premiums. Many insurers, including State Farm, Travelers, and Progressive, offer savings for:

- Safe driving: Maintaining a clean record can qualify you for a good driver discount.

- Bundling policies: Combining auto and home insurance can lead to significant savings.

- Driver’s education: Young or new drivers can earn discounts by completing a driver’s education course.

- Safety features: Vehicles equipped with anti-theft devices, airbags, or advanced safety systems may qualify for additional discounts.

Comparing cheap auto insurance in Rhode Island can help you find the best car insurance discounts for your situation.

Pros

Pros

Pros

Pros

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros