- Limited High-Risk Coverage: While rates are affordable for many, individuals with accidents, DUIs, or SR-22 requirements may encounter higher premiums or limited coverage options.

- Fewer Customization Options: Some insurers may lack specialized add-ons, such as new auto replacement coverage, which could be important for certain policyholders.

- No Gap Insurance: Not all providers offer gap insurance, which is essential for drivers with financed or leased vehicles to cover the difference between the auto’s value and the remaining loan balance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

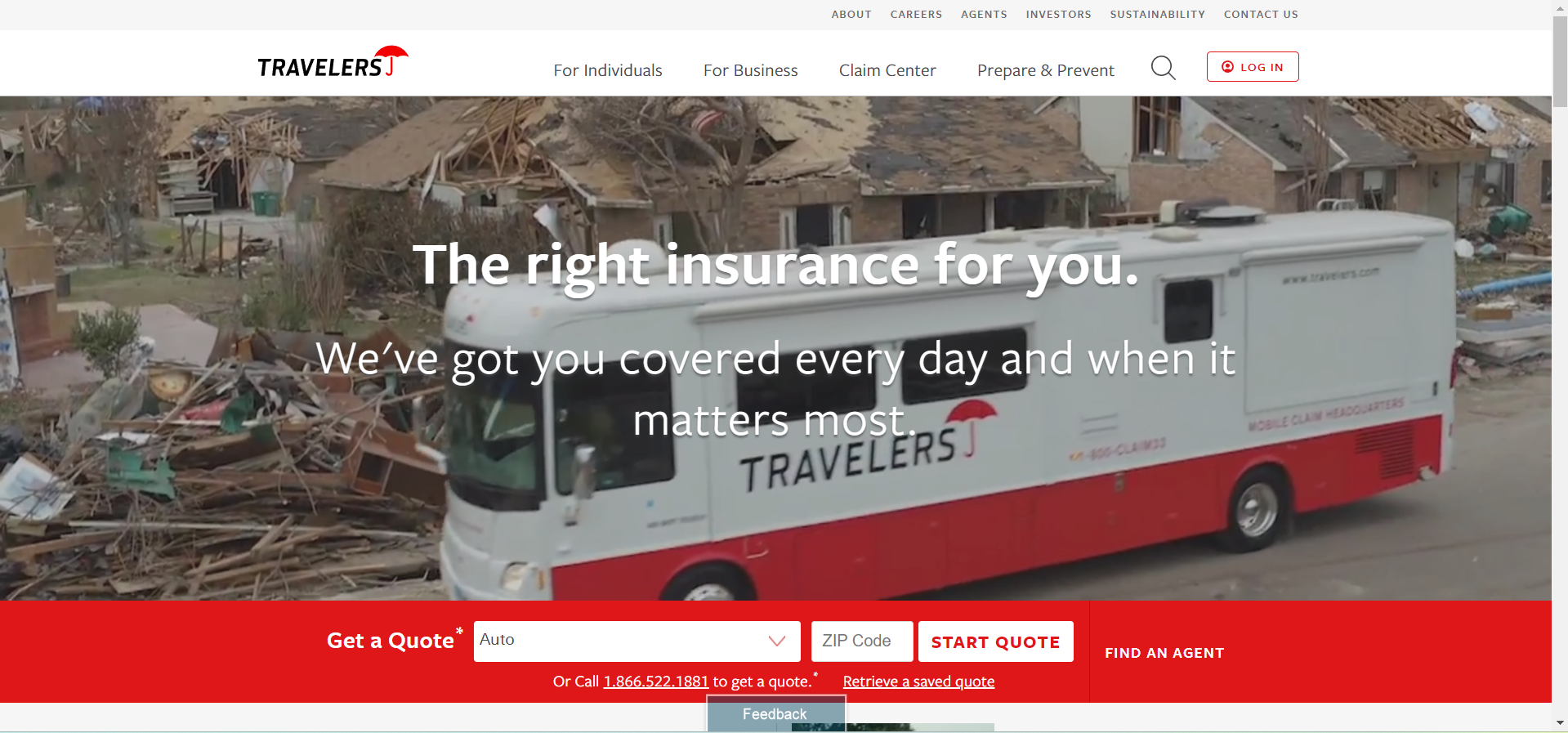

#2 – Travelers: Cheapest Rates for Coverage Options

Pros

Pros

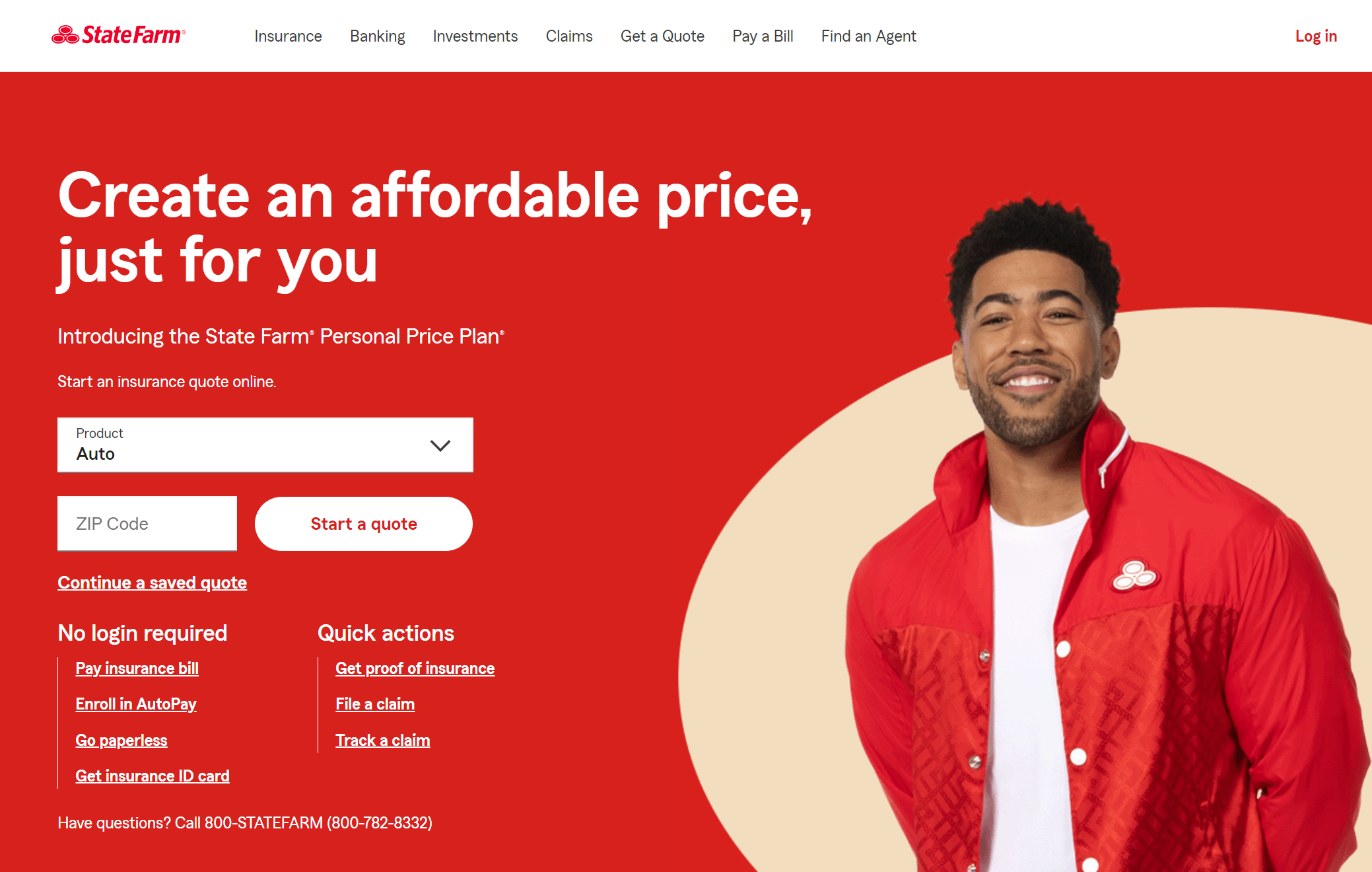

- Competitive Rates: Travelers offers cheap auto insurance in Rhode Island, starting at $44 a month. Read our review of Travelers to learn more.

- Strong Discount Options: Save up to 13% with multi-policy bundling, 10% for safe driving, and 5%–8% for insuring a hybrid or electric vehicle.

- Accident Forgiveness: If you qualify, you can avoid rate increases after your first accident, helping to keep premiums stable over time.

- Customizable Coverage: For extra financial protection, it offers add-ons like roadside assistance, new auto replacement, and gap insurance.

Cons

- Higher Base Rates: Travelers’ starting premiums tend to be higher than State Farm’s $32 rate, making it less competitive for budget-conscious drivers seeking low-cost auto insurance in Rhode Island.

- Limited Local Agents: Compared to major insurers like State Farm, there are fewer in-person offices, which may be a drawback for those who prefer face-to-face support.

- Mixed Customer Reviews: Some policyholders report slower claims processing times compared to competitors, which can be frustrating after an accident.

#3 – Progressive: Affordable For High-Risk Drivers

Pros

Pros

- Affordable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $49 a month. Our complete Progressive review covers this in more detail.

- Name Your Price Tool: This allows drivers to set a budget and find policies that match their price range—ideal for those seeking budget-friendly auto insurance in Rhode Island.

- Large Discount Selection: Save with multi-policy (up to 5%), good driver (up to 31%), and online quote discounts.

- Strong Digital Experience: It provides easy online quotes, policy management, and claims filing, making it convenient for tech-savvy drivers.

Cons

- Higher Rates for High-Risk Drivers: It can be expensive for those with accidents, DUIs, or multiple violations on their record.

- Customer Service Varies: Some policyholders report inconsistent support, with delays in claims processing.

- Limited Local Agent Support: Primarily an online-based insurer, which may not be ideal for drivers who prefer in-person assistance.

#4 – Geico: Employee Discounts

Pros

Pros

- Affordable Rates: The company offers cheap auto insurance in Rhode Island, starting at $53 a month. Learn more about Geico’s rates in our Geico auto insurance company review.

- Generous Discounts: Save with military (up to 15%), federal employee, multi-policy (up to 25%), and safe driver (up to 22%) discounts, making Geico an excellent option for auto insurance discounts in Rhode Island.

- Easy Online Access: A user-friendly app and website allow for quick quotes, easy claims filing, and seamless policy management.

- Strong Financial Stability: Geico has a solid industry reputation and a history of reliable claims handling.

Cons

- Limited Local Agents: Fewer in-person support options compared to competitors like State Farm.

- Higher Rates for High-Risk Drivers: Premiums can be significantly more expensive for drivers with accidents, DUIs, or poor credit scores.

- Fewer Customization Options: It offers limited add-ons compared to insurers like Travelers or Progressive, which provide more coverage flexibility.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – American Family: Cheapest for Loyalty Savings

Pros

Pros

- Competitive Pricing: The company offers cheap auto insurance in Rhode Island, starting at $64 a month. Find out more about American Family in our American Family review.

- Excellent Discount Options: Save with bundling (up to 29%), loyalty, good student (up to 25%), and safe driver (up to 20%) discounts.

- Strong Customer Service: Highly rated support team with local agents available for personalized assistance.

- Customizable Coverage: It offers add-ons like accident forgiveness, roadside assistance, and gap insurance for better protection.

Cons

- Higher Base Rates: Starting premiums are often higher than competitors like State Farm ($32) and Geico, making it challenging to secure competitive auto insurance rates in Rhode Island.

- Limited Availability: Fewer locations and agents, making in-person support less accessible compared to major national insurers.

- Slower Claims Processing: Some customers report delays in claim approvals and payouts, leading to longer wait times.

#6 – Farmers: Cheapest for Family Drivers

Pros

Pros

- Reliable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $78 a month. Read our Farmers Insurance company review to learn more.

- Diverse Discount Options: Save with bundling (up to 20%), good driver (up to 15%), multi-car (up to 10%), and professional group discounts—an excellent option for those seeking wallet-friendly auto insurance in Rhode Island.

- Strong Local Agent Network: This offers personalized service with a large in-person support network.

- Customizable Policies: Includes add-ons like new auto replacement, accident forgiveness, and customized equipment coverage.

Cons

- Higher Starting Rates: More expensive than competitors like State Farm ($32) and Geico.

- Mixed Customer Reviews: Some policyholders report inconsistent claims handling and unexpected rate increases.

- Limited Digital Experience: Online tools are less advanced than those of Geico or Progressive, making policy management less convenient.

#7 – Allstate: Cheapest For Detailed Coverage

Pros

Pros

- Reliable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $80 a month. Read more about this provider in our Allstate auto insurance review.

- Many Discount Options: You can save with bundling, safe driver, new auto, and multi-policy discounts- providing fair-priced auto insurance in Rhode Island for quality protection.

- Strong Local Agent Support: This option offers personalized service with in-person assistance, making it a good choice for those who prefer face-to-face interactions.

- Comprehensive Add-Ons: Includes accident forgiveness, roadside assistance, and new auto replacement for added coverage flexibility.

Cons

- Higher Premiums: It is more expensive than competitors like State Farm ($32) and Geico, making it less budget-friendly.

- Mixed Customer Satisfaction: Some drivers report high renewal rates and delays in claims processing, impacting overall experience.

- Strict Eligibility for Discounts: While there are many savings opportunities, some require specific conditions to qualify, limiting accessibility.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Cheapest For Accident Forgiveness

Pros

Pros

- Affordable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $81 a month. You can learn more in our Nationwide auto insurance review.

- Vanishing Deductible: You can reduce your deductible for every year of safe driving, helping lower out-of-pocket costs in the long run.

- Strong Discount Options: Save with bundling, good driver, accident-free, and multi-policy discounts, making coverage more affordable.

- Comprehensive Coverage Add-Ons: These offer extras like roadside assistance, gap insurance, and accident forgiveness for enhanced protection, ideal for those seeking budget auto insurance in Rhode Island.

Cons

- Higher Base Rates: More expensive than budget-friendly competitors like State Farm ($32) and Geico, making it less appealing for cost-conscious drivers.

- Limited Local Agents: Compared to companies like Allstate, there are fewer in-person support options, which may affect customer service accessibility.

- Strict Eligibility for Some Discounts: Certain discounts have specific qualification requirements, limiting access for some policyholders.

#9 – Liberty Mutual: Customizable Coverage

Pros

Pros

- Customizable Coverage: The company offers cheap auto insurance in Rhode Island, starting at $ 100 a month. Learn more about this provider in our thorough Liberty Mutual company review.

- Unique Discounts: Liberty Mutual provides several discounts, including bundling policies, rewards for good students, and the RightTrack program, which monitors safe driving habits to potentially lower premiums and help secure inexpensive auto insurance in Rhode Island.

- Accident Forgiveness: This feature ensures that your premium doesn’t increase after your first accident, promoting peace of mind for drivers.

- Strong Digital Tools: The company offers robust online policy management and claims processing tools, enhancing customer convenience.

Cons

- Higher Premiums: Some customers report that Liberty Mutual’s premiums can be more expensive than those of competitors like State Farm and Geico.

- Mixed Customer Reviews: Feedback varies, with some drivers noting high renewal rates and delays in claims processing.

- Discount Eligibility Varies: Availability and eligibility for certain discounts may depend on factors such as driving history and location.

#10 – Erie: Cheapest For Full Coverage

Pros

Pros

- Competitive Pricing: The company offers cheap auto insurance in Rhode Island, starting at $105 a month. Read our in-depth Erie auto insurance review to find the best policy for your needs.

- Rate Lock Feature: Erie’s Rate Lock allows policyholders to maintain consistent premiums unless they make specific policy changes, such as adding or removing a vehicle or driver or changing their address—ideal for those seeking money-saving auto insurance in Rhode Island.

- Highly Rated Customer Service: The company has received above-average ratings for customer satisfaction and claims handling.

- Comprehensive Coverage Options: Erie offers various coverage options, including accident forgiveness, new auto replacement, pet injury coverage, and diminishing deductibles.

Cons

- Limited Availability: Erie’s services are confined to 12 states and Washington, D.C., limiting access for potential customers in other regions.

- Higher Starting Rates: More expensive than insurers like State Farm and Geico.

- Fewer Online Tools: The company’s digital experience is not as advanced as some competitors, lacking features like online claims filing through their mobile app.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Costs & Coverage in RI

Looking for cheap auto insurance in Rhode Island? Our top 10 company picks offer affordable rates and excellent coverage. The table below shows the best options available.

Rhode Island Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $80 | $189 | |

| $64 | $151 | |

| $105 | $195 |

| $78 | $183 | |

| $53 | $125 | |

| $100 | $235 |

| $81 | $190 |

| $49 | $116 | |

| $32 | $76 | |

| $44 | $103 |

Pros

Pros

Pros

Pros

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros