Cheap Auto Insurance in Arkansas for 2024 (Save With These 10 Companies)

The companies that rank highest in cheap auto insurance in Arkansas are State Farm, Geico, and Liberty Mutual, and their rates start at $28 monthly. These insurance companies are regarded as the best in Arkansas since they provide excellent discounts and cheap rates.

Free Auto Insurance Comparison

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Nov 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

17,759 reviews

17,759 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

17,759 reviews

17,759 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

19,116 reviews

19,116 reviews 3,607 reviews

3,607 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

3,607 reviews

3,607 reviewsThe top pick list of cheap auto insurance in Arkansas with the lowest monthly premiums are State Farm, Geico, and Liberty Mutual, with $28 per month.

They provide affordable coverage with multiple discounts, safe driving rewards, and other perks to ensure Arkansans get the best value on car insurance quotes in Heber Springs, AR. You’ll appreciate their competitive rates, strong financial stability for policyholders, and the top-notch customer service they offer.

Our Top 10 Company Picks: Cheap Auto Insurance in Arkansas

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $28 | B | Safe-Driving Discounts | State Farm | |

| #2 | $31 | A++ | Competitive Premiums | Geico | |

| #3 | $34 | A | Telematics-Based Savings | Liberty Mutual |

| #4 | $42 | A | Bundling Discounts | Safeco | |

| #5 | $44 | A+ | Cost-Saving Programs | Nationwide |

| #6 | $45 | A+ | Extensive Discount | Progressive | |

| #7 | $47 | A | Multi-Policy Savings | American Family | |

| #8 | $51 | A | High-Risk Drivers | The General | |

| #9 | $56 | A | Comprehensive Coverage | Farmers | |

| #10 | $57 | A+ | Local Presence | Allstate |

Car insurance discounts like multi-policy rebates provide an opportunity for high-risk drivers in Arkansas to find affordable coverage that meets their needs for any driving-related situation in the state. To get quotes now, simply Enter your ZIP code using the free tool above.

- Cheap auto insurance in Arkansas for high-risk drivers

- Save with discounts for safe driving and policy bundling in Arkansas

- State Farm is the most affordable from our list at $28 monthly

#1 – State Farm: Top Overall Pick

Pros

- Most Affordable Rates: In a State Farm auto insurance review, this charge makes it one of the cheapest brands a consumer can get in Arkansas, with a minimum monthly charge of $28.

- Safe-Driving Rewards: The application of discounts to its car insurance customers in Arkansas can make driving safer while reducing drivers’ expenses.

- Comprehensive Coverage Options: Auto insurance choices include liability, collision, comprehensive insurance, and other insurance Arkansas drivers can choose and acquire from State Farm.

Cons

- Limited Telematics Options: Currently, State Farm offers no state-of-the-art telematics programs for car insurance clients in Arkansas, while some competitors do.

- Mixed Customer Satisfaction: For Auto insurance in Arkansas, A.M. Best awards them a B rating, which means poor customer relations.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Premiums

Pros

- Affordable Starting Premiums: According to a Geico auto insurance review, the company sells car insurance in Arkansas, and the minimum monthly premium available is $31.

- Multiple Discounts Available: Geico offers discounts with low claim rates, and a policyholder can secure numerous policies together. They are making it possible for most customers in Arkansas.

- Strong Financial Stability: Geico has an A++ rating by A.M. Best, proving that the company is in good financial standing, which reassures drivers when searching for auto insurance in Arkansas.

Cons

- Fewer Local Offices: It has fewer local offices in Arkansas, which might be a hassle to its customers who want to have flesh-and-blood help concerning their automobile insurance.

- Expensive for Younger Drivers: Geico’s forcing car insurance is relatively higher in Arkansas for younger drivers than other companies.

#3 – Liberty Mutual: Best for Telematics-Based Savings

Pros

- Telematics Discounts: Liberty Mutual has its RightTrack program for Auto insurance in Arkansas, through which healthy drivers with a starting monthly premium of $34 are encouraged.

- Flexible Coverage Options: Liberty Mutual offers adaptable car insurance in Arkansas with perks like accident forgiveness and new car replacements.

- Solid Financial Foundation: The company has a sound rating from A.M. Best, especially in processing claims of customers with vehicle insurance in Arkansas.

Cons

- Higher Base Rates: While Liberty Mutual’s initial price of $34 is reasonable, it may not be the most affordable for Affordable auto insurance in Arkansas.

- Customer Service Issues: According to the Liberty Mutual auto insurance review, most Arkansas car insurance policyholders have a problem with inconsistent assistance over claims.

#4 – Safeco: Best for Bundling Discounts

Pros

- Significant Bundling Discounts: Arkansas customers can cut their bill by a third or more by bundling Safeco’s auto insurance with home or renters insurance for as low as $42 a month.

- Comprehensive Add-Ons: Safeco’s auto insurance in Arkansas offers additional features like roadside assistance and rental car coverage while your vehicle is in for repairs.

- Easy Mobile Access: The insurance services provider has designed a friendly interface for Arkansas car insurance policyholders to access their plans, policies, and claims through a mobile application.

Cons

- Higher Starting Premiums: Nonetheless, Safeco auto insurance review indicates that car insurance in Arkansas costs $42 per month, which is not the cheapest in the state.

- Mixed Customer Service Feedback: Satisfying customer experience has become a crucial dimension in satisfaction amongst Arkansas vehicle insurance clients with mixed feedback.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Cost-Saving Programs

Pros

- Innovative Savings Initiatives: Nationwide’s vanishing deductible in Arkansas gives drivers a break on auto insurance by eliminating cements of their deductibles for every year of safe driving.

- Customizable Coverage Options: Arkansas drivers can effortlessly coordinate according to their policies, which include extras such as roadside assistance and accident forgiveness.

- Responsive Customer Service: Nationwide is reputable for offering excellent customer service. Thus, it takes little time for a policyholder with automobile insurance in Arkansas to sort out their issues.

Cons

- Higher Premiums: In Arkansas, Nationwide’s Vanishing Deductible helps drivers save by gradually reducing their deductible for safe driving.

- Fewer Discounts: Arkansas consumers seeking vehicle insurance may find that a Nationwide auto insurance review shows the company offers fewer discounts than other auto insurers.

#6 – Progressive: Best for Extensive Discounts

Pros

- Discount Options: The qualified driver in Arkansas is eligible to acquire a discount on the monthly premiums from $45 each month at Progressive for good drivers.

- Usage-Based Savings: Arkansas citizens can be enrolled under Progressive’s Snapshot, and their driving behavior will be tracked with incentives for safer driving options.

- Flexible Coverage Options: It gives the option to policyholder their choice and need for options like gap and custom parts insurance under Arkansas automobile insurance.

Cons

- Confusing Pricing Structure: With so many discounts and coverage options, Progressive’s price offers may have to be explained to Arkansas car insurance buyers.

- Potential Higher Costs: Arkansas consumers seeking vehicle insurance may find that a Progressive auto insurance review shows the company offers more discounts than other insurers.

#7 – American Family: Best for Multi-Policy Savings

Pros

- Generous Multi-Policy Discounts: Arkansas customers can receive a discount on car insurance by bundling their auto policies with other products like home or life insurance through American Family.

- Flexible Payment Options: Arkansas drivers can get discounts on car insurance by bundling with home or life insurance through American Family.

- Comprehensive Coverage Features: Other endorsements include identity theft for Arkansas and gap for vehicle insurance in Arkansas.

Cons

- Higher Premiums: The $47 monthly cost for an American Family auto insurance review can be highly expensive for drivers in Arkansas, but their pricing is pretty aggressive compared to most providers.

- Mixed Customer Service Feedback: Many Arkansas-based American Family policyholders always complain about the services rendered to them. This may thus affect general satisfaction regarding auto insurance.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

#8 – The General: Best for High-Risk Drivers

Pros

- Coverage For High-Risk Drivers: The General provides car insurance in Arkansas for people with previous accidents or citations that have restricted them from other insurance companies.

- Fast Car Insurance Quotes: The General purposely tailors their options for people who need fast Quotes Online, which helps those with higher risks get Arkansas insurance quickly.

- Flexible Payment Plans: Consumers with vehicle insurance in Arkansas can create flexible monthly installments of $51 for The General auto insurance review product.

Cons

- Higher Premiums For High-Risk Drivers: The General’s starting premium of $51 may be more costly than other Auto insurance in Arkansas for high-risk drivers.

- Limited Policy Customization: Arkansas car insurance customers may have fewer options to customize their policy than others.

#9 – Farmers: Best for Comprehensive Coverage

Pros

- Extensive Options Coverage: Arkansas vehicle insurance, offered by Farmers, offers options on customizable add-ons, including rental reimbursement and rideshare cover.

- Bundled Policies Discounting: Arkansas vehicle insurance customers can pocket some cash by bundling their auto insurance policy with other Farmers’ products like home or life insurance.

- Local Caring: You find hundreds of agents throughout the country; with this, Arkansas vehicle insurance customers are assured of being offered personal touch from local Farmers’ representatives.

Cons

- Higher Premiums: Starting at $56 per month, Farmers may not be Arkansas’s most affordable auto insurance option for budget-conscious drivers.

- Complex Coverage Options: Arkansas drivers are exposed to many policy options and add-ons, so new customers must read and review a Farmer auto insurance review.

#10 – Allstate: Best for Local Presence

Pros

- Local Agent Network: Arkansas clients benefit from customized, in-person assistance.

- Variety of Coverage Types: Allstate is very flexible in assembling policies in Arkansas, so see the Allstate auto insurance review for possible discounts.

- Discount Programs: Drivers in Arkansas can enjoy savings with an array of Allstate discounts, such as safe driving and bundling policy discounts.

Con

- Expensive Premiums: Allstate’s rates for drivers in Arkansas are $57 per month, which can be high.

- Customer Service Reviews: Some Arkansas insurance companies have varying experiences with Allstate regarding when it can reach its service and claims.

Enter your ZIP code below to compare auto insurance rates.

Secured with SHA-256 Encryption

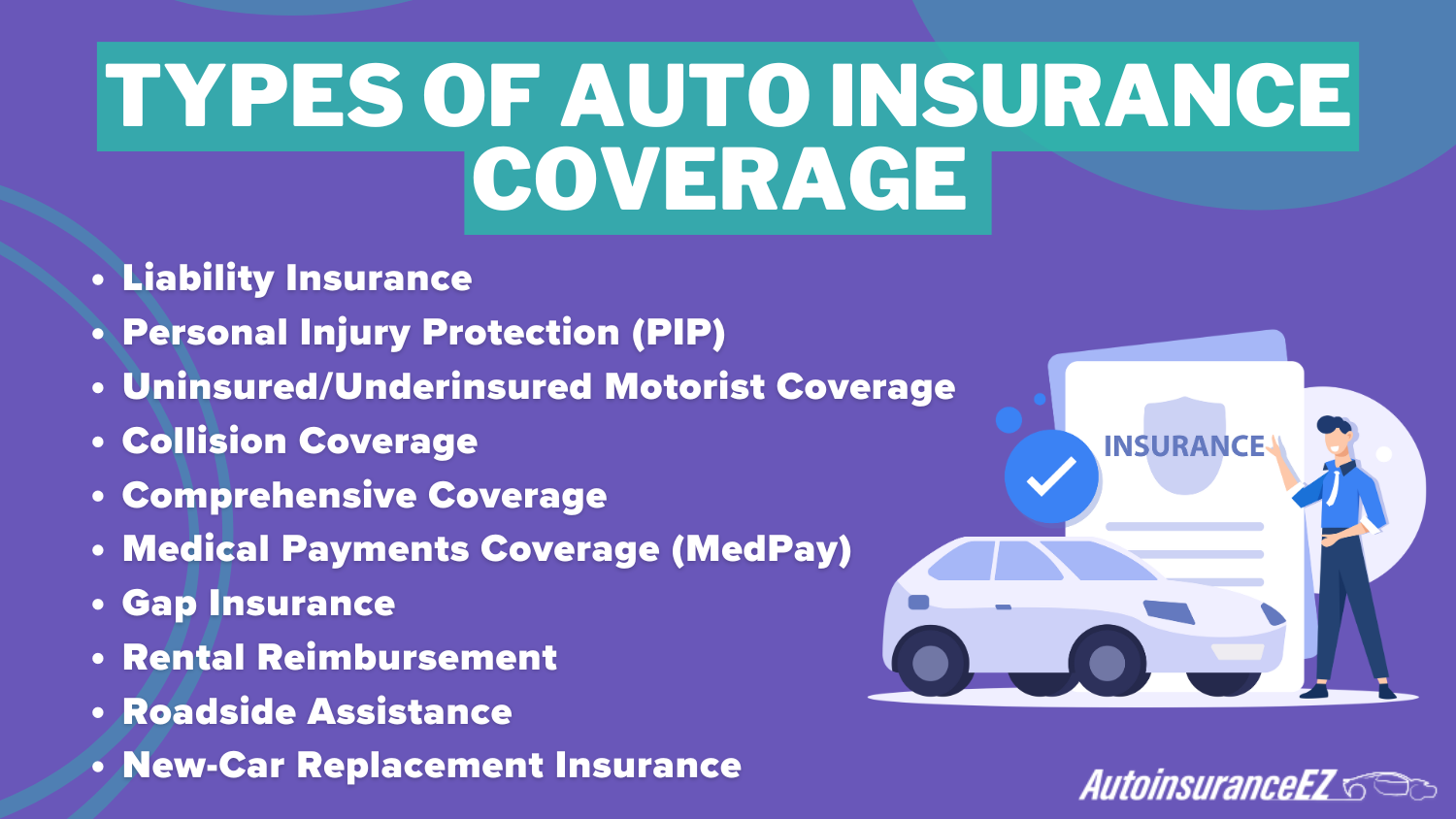

Arkansas Coverage and Rates

Arkansas drivers can choose from a range of auto insurance coverage options, and rates vary by provider and the selected coverage level. State Farm has the cheapest insurance of any provider in our search, with a minimum coverage policy available for just $28 per month, compared to a full coverage policy from Farmers that can run you up to $165 per month.

Arkansas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $162 | |

| $47 | $137 | |

| $57 | $165 | |

| $31 | $91 | |

| $34 | $99 |

| $44 | $128 |

| $45 | $131 | |

| $42 | $122 | |

| $28 | $80 | |

| $51 | $135 |

Prices from other providers are also great, with Geico providing full coverage for $91 a month and Liberty Mutual for $99. Arkansas car insurance’s average monthly cost is about $77 in some cities. Fort Smith (average $84), Fayetteville/Springdale/Rogers (average $71), one of the cheapest places for car insurance in Arkansas.

Frequently Asked Questions

Which companies offer affordable auto insurance in Arkansas?

Top companies for cheap auto insurance in Arkansas include State Farm, Geico, and Liberty Mutual, offering rates starting at $28 per month. Uncover more about our best Fayetteville, AR auto insurance by reading further.

What is the average cost of cheap auto insurance in Arkansas?

The average cost of cheap auto insurance in Arkansas is about $77 per month, varying by coverage level and individual factors. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What are Arkansas’s minimum auto insurance requirements?

In Arkansas, minimum auto insurance coverage must include $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage, though higher limits provide better protection.

What discounts exist for auto insurance in Arkansas?

Discounts for cheap auto insurance may include safe driving, multi-policy savings, and good student discounts. Look at our best Jonesboro, AR auto insurance for expanded insights.

How much is car insurance in Arkansas?

The average cost of car insurance in Arkansas is around $77 per month, but rates vary, so comparing Arkansas car insurance quotes is essential.

Which provider has the cheapest auto insurance in Arkansas?

State Farm offers the cheapest auto insurance in Arkansas, with minimum coverage rates starting at $28 per month.

What are the penalties for driving uninsured in Arkansas?

Driving without insurance can lead to hefty fines and legal consequences in Arkansas, so valid insurance is essential. Delve into the depths of our best Little Rock, AR auto insurance for additional insights.

Can I get auto insurance in Arkansas without a driver’s license?

It’s difficult to get cheap auto insurance without a valid driver’s license, but some providers may offer limited options.

Can high-risk drivers find cheap auto insurance in Arkansas?

Yes, providers like The General offer affordable auto insurance options for high-risk drivers in Arkansas.

How can I compare cheap auto insurance rates in Arkansas?

You can compare rates by entering your ZIP code on insurance comparison websites to receive multiple quotes. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Why check financial ratings for auto insurance in Arkansas?

Checking financial ratings is important as it reflects an insurer’s reliability in processing claims and financial stability. Dive deeper into our best Fort Smith, AR auto insurance for a comprehensive understanding.